Gross profit rate formula calculator

The formula to calculate the gross profit is as follows. Figure out Gross ProfitResale - Cost Gross Profit12 resale - 7 cost 5 Gross ProfitStep 2.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

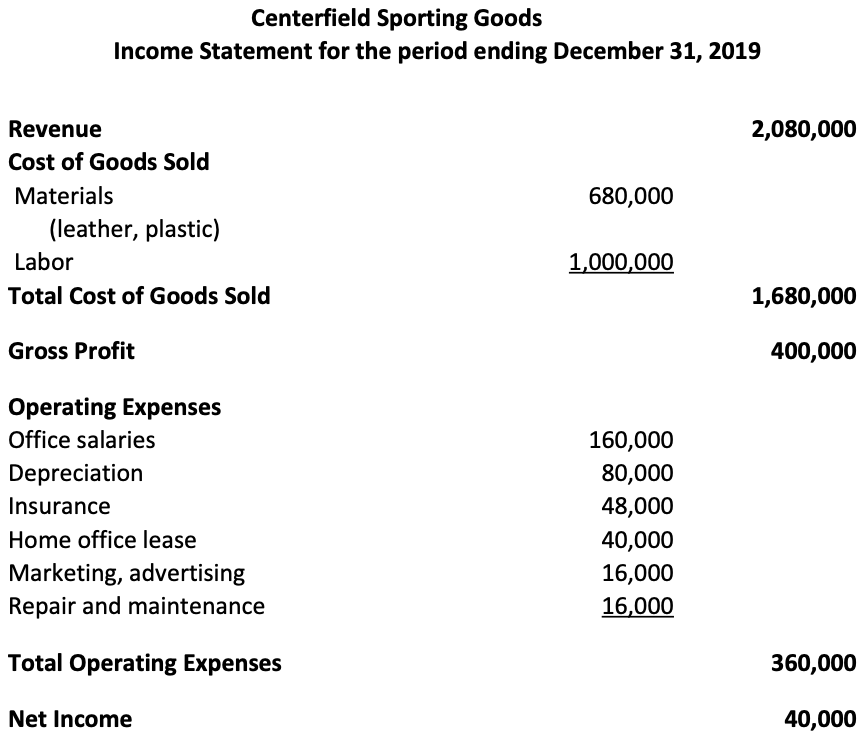

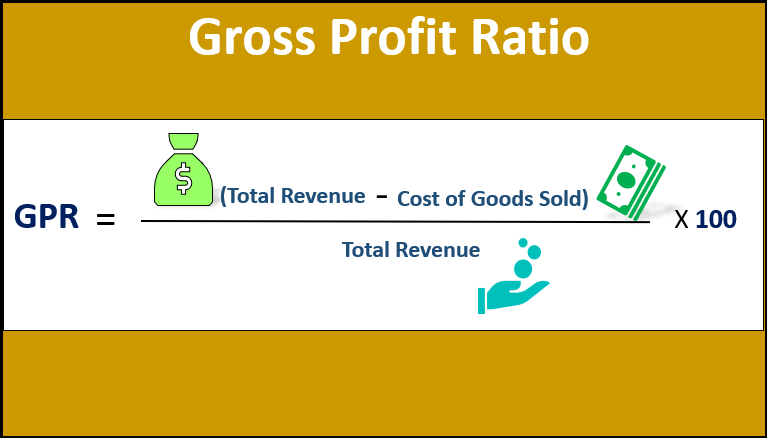

Gross Profit Revenue Cost of Goods Sold COGS As a standalone metric the gross income is not very.

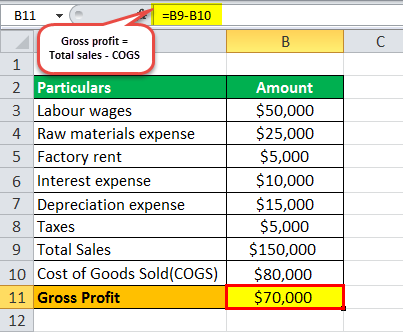

. Over a decade of business plan writing experience spanning over 400 industries. Gross profit 70000. But firstly its important to know What is a Gross Profit.

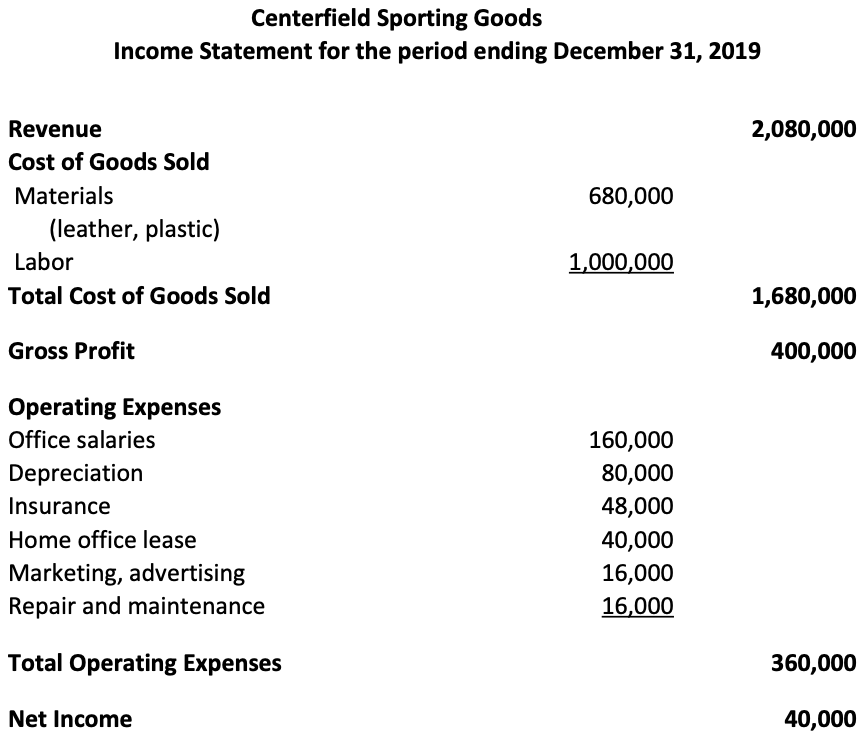

Total revenue and cost of goods sold. The gross profit margin is a financial ratio which is a measurement of a companys manufacturing and distribution efficiency during the production process. Using the above gross profit.

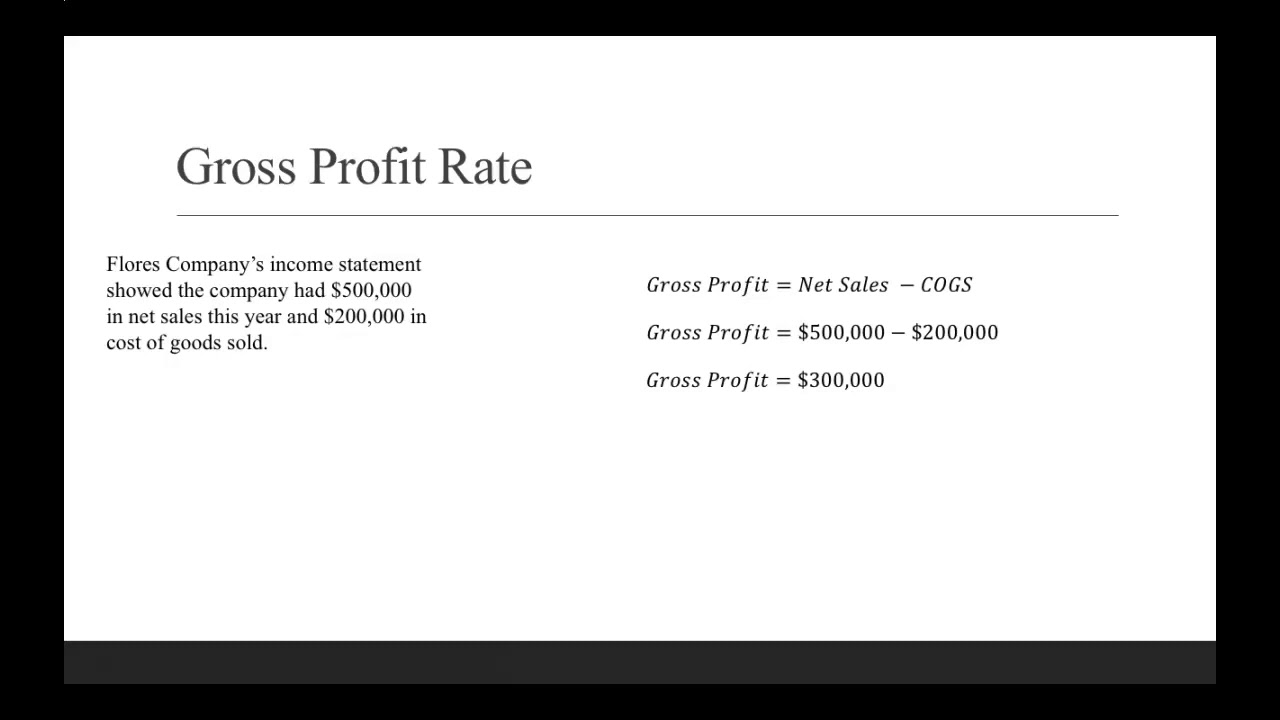

Gross profit Sales - Cost of Goods Sold. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. Divide the original price of your goods by 08.

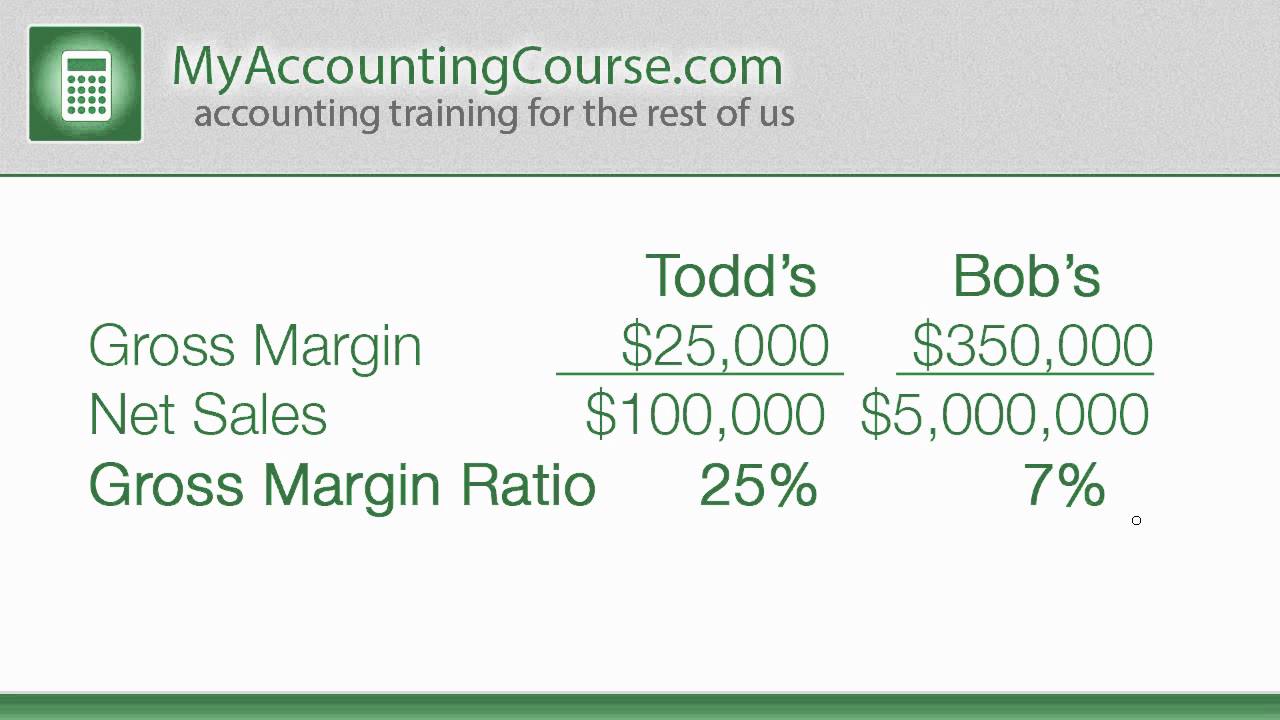

You can calculate gross profit using the following formula. The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales. Divide Gross Profit by Resaleand multiply times 100 to get the.

Therefore the calculation of gross profit. Gross Profit 150000 105000. It is calculated as a.

Lets assume that Company A purchased a. Gross Profit Sales Cost of Goods Sold. Gross Profit is calculated using the formula given below.

150000 80000. Now lets take a look at the example below. Lets be honest - sometimes the best gross profit margin calculator is the one that is easy to use and doesnt require us to even know what the gross profit margin formula is in the first place.

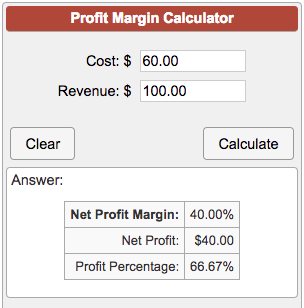

Net Profit Margin Net Profit Revenue. Gross Profit Net Sales COGS. The gross profit margin formula Gross Profit Margin Revenue Cost of Goods Sold Revenue x 100 shows the percentage ratio of revenue you keep for each sale after all costs are.

The above gross profit rate formula calculates Revenue from net sales and sales. Where Net Profit Revenue -. Gross profit is equal to net sales minus cost of goods sold.

Two Simple StepsStep 1. For gross profit gross margin percentage and mark up percentage see the Margin Calculator. Subtract 02 from 1 to get 08.

Gross Profit 1200 - 320. You can calculate gross profit margin ratios with the use of two inputs. That is how much you should charge for a 20 profit margin.

Gross Profit Revenue - Cost of Goods Sold. Gross Profit 880. Cost of Goods Sold COGS Opening Stock Purchase Direct Expenses.

Cost of Goods Sold 320. The formula for calculating the gross profit is as follows. Gross margin is the metric tool that measures the total money left over after paying the cost of goods sold.

Gross Profit 45000. Now we will calculate the gross profit by using data given Gross profit Total sales COGS. A Gross Profit Ratio Calculator is quite a handy tool to check the profitability as well as the financial performance of a company.

Cost of Goods Sold 080 x 400. How do you calculate the gross margin ratio. For example if a product costs.

This gives you the gross profit percent which you can evaluate to determine profitability. Using the example retail company apply the formula when the gross profit is.

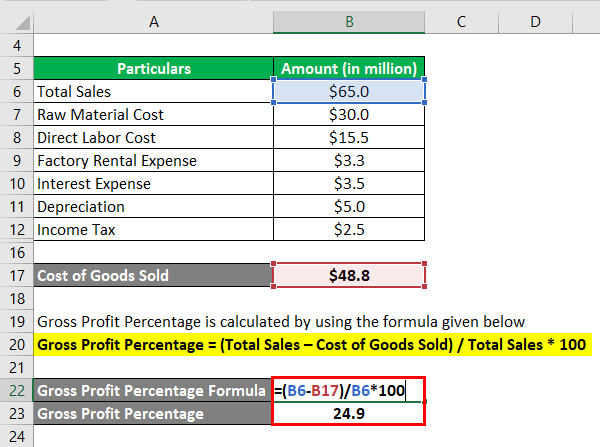

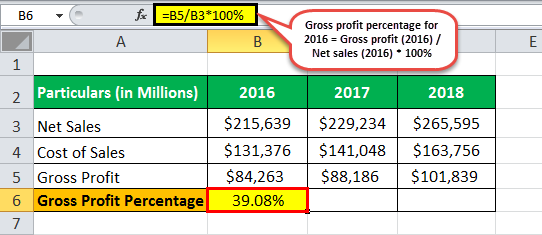

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Gross Margin Ratio Formula Analysis Example

Gross Profit Ratio Top 3 Examples Of Gross Profit Ratio With Advantages

Solved Calculate The Profit Margin And Gross Profit Rate Chegg Com

Calculating The Gross Profit Rate Youtube

Gross Profit Percentage Top 3 Examples With Excel Template

Gross Profit Percentage Formula Calculate Gross Profit Percentage

What Is Gross Margin And How To Calculate It Article

Gross Profit Margin Formula Definition Investinganswers

Gross Profit Percentage Top 3 Examples With Excel Template

Operating Profit Margin How To Calculate Operating Profit Margin

How To Calculate Gross Margin Percentage Incubeta Panalysis

Profit Margin Calculator

Margin Calculator

Gross Profit Margin Formula And Calculator Excel Template

Gross Profit Percentage Formula Calculate Gross Profit Percentage

What Is Gross Profit Margin Definition Formula Accounting Corner